Selling rental property tax calculator

You can claim 1000 as a tax-free property allowance. Assume that the capital gain is 134400 in the case of a sale price of 74910 adjusted basis and that the long- term capital gains tax rate is 8.

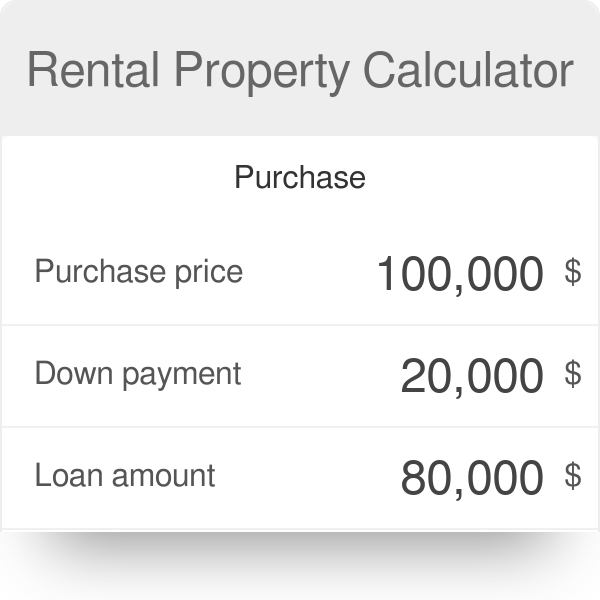

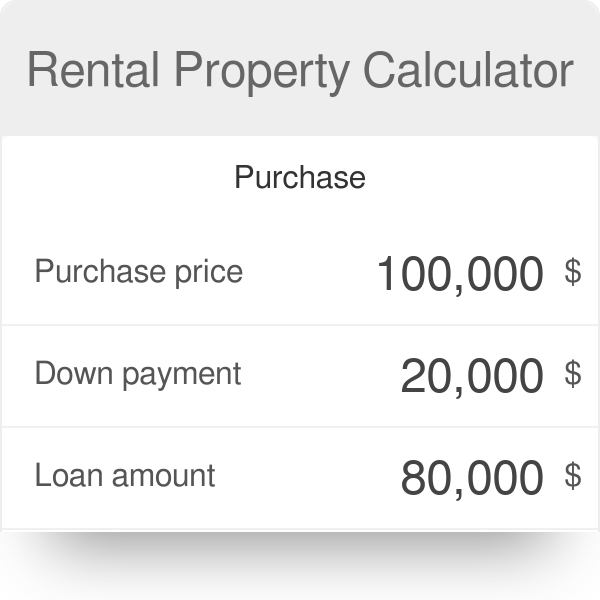

Rental Property Calculator Most Accurate Forecast

The math gets more complex.

. For comparison the median home value in California is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you buy a property that trades at an 8 cap rate then raise the net.

Percentage representation of agentCommissionInput. On top of that California will charge another 1 to 133 when you sell. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of 750000.

Capital Gains x. The standard costs of the home sale transaction paid at closing. Depreciation recapture tax rates.

This handy calculator helps you avoid tedious number-crunching but it should only be used for. This means that if an investor is in a 22 marginal tax bracket and their rental income is 5000 the investor would end up paying 1100. So if youre a millionaire your total capital gains taxes will be 333.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. Estate agents commission In London is about 3 multi agent and 1 exclusive Foxtons. As a result your taxable rental income will be.

Rental income tax breakdown. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream. Rental income is taxed as ordinary income.

This is usually around 1500. How to Calculate Capital Gains Tax on Rental Property. Rental Income Formula Gross Rental Income Monthly Rent 12 months 1 - Vacancy Rate 100 The vacancy rate is the amount of time your property is empty.

Selling Price of Rental Property - Adjusted Cost Basis. Property 5 days ago Capital Gains. Your rental earnings are 18000.

Capital gains on the sale of a co-owned rental property. Calculate the Adjusted Basis for Your Property Adjusted basis is the net value of a rental property after making tax adjustments listed in IRSs Publication 551. Use this tool to estimate capital gains taxes you may owe after selling an investment property.

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate Rental Income The Right Way Smartmove

Rental Property Calculator Most Accurate Forecast

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Converting A Residence To Rental Property

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Tax Calculator For Rental Property Top Sellers 58 Off Www Ingeniovirtual Com

Rental Property Is Now The Right Time To Sell

Rental Property Calculator How To Calculate Roi

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Calculating Returns For A Rental Property Xelplus Leila Gharani

Canada Capital Gains Tax Calculator 2022

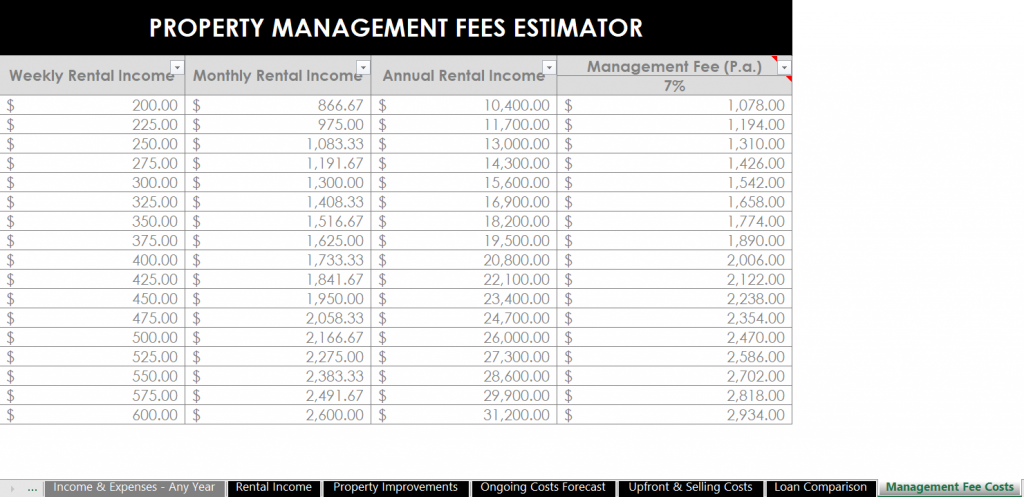

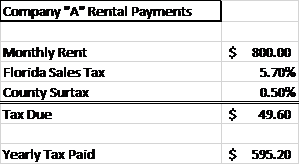

How To Calculate Fl Sales Tax On Rent