Retirement income tax calculator 2021

Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. Your household income location filing status and number of personal.

Social Security Benefits Tax Calculator

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

. Home financial. The Income Tax Calculator estimates the refund or. Figure your monthly Federal income tax withholding.

This rule suggests that a. IR-2019-155 September 13 2019. RRSP Registered Retirement Savings Plan This government sponsored financial planning program allows Canadian residents to contribute 18 of their previous years earned income.

Social Security is taxed on provisional income non retirement accounts are taxed based on current income andor capital gains taxes and retirement accounts are taxed even different. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Our Resources Can Help You Decide Between Taxable Vs.

Dont Wait To Get Started. Retirement tax calculator 2021 Jumat 09 September 2022 Edit. Your retirement is on the horizon but how far away.

Ad Find Retirement Tax Calculator. Use SmartAssets set of calculators to find out the taxes in your state. The beneficiarys adjusted gross income AGI found on line 11 of the Internal Revenue Service IRS tax filing form 1040 plus.

And is based on the tax brackets of 2021 and. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. Automated Investing With Tax-Smart Withdrawals.

It is mainly intended for residents of the US. Federal Employees Group Life Insurance FEGLI calculator. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

We have the SARS tax rates tables. Prepare For Your Future Today. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500. Modified Adjusted Gross Income MAGI is the sum of. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

Based on your projected tax withholding for the year we can also estimate. Free step-by-step webinar September 19. This means that you are taxed at 205 from.

Enter your filing status income deductions and credits and we will estimate your total taxes. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Between 25000 and 34000 you may have to pay income tax on. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. In 60 seconds calculate your odds of running out of money in retirement.

Start Today With Our Free Easy to Use Online Chat. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Take Charge Of Your Retirement Savings Today With These Quick And Personalized Tips.

On the other hand taxes in a state like. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. Retirees can expect to have a very small tax bill.

Use Our Retirement Advisor Tool To Help Determine Your Retirement Income Goals. Office of Personnel Management. Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

California Retirement Tax Friendliness Smartasset

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Federal Income Tax Calculator Atlantic Union Bank

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Tax Withholding For Pensions And Social Security Sensible Money

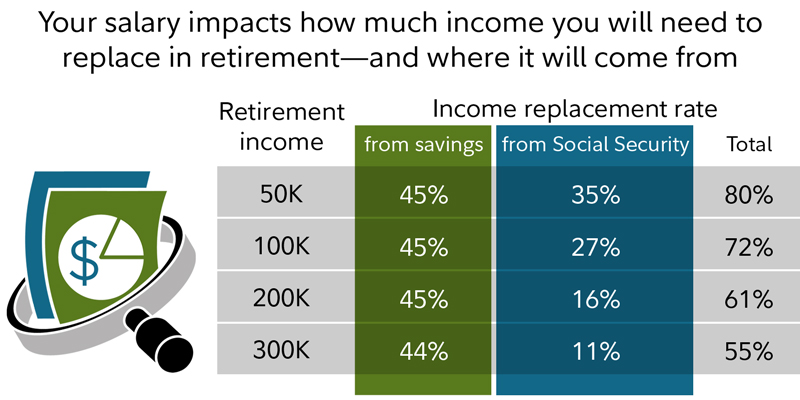

What Will My Savings Cover In Retirement Fidelity

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Tax Withholding For Pensions And Social Security Sensible Money

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Calculator Estimate Your Income Tax For 2022 Free